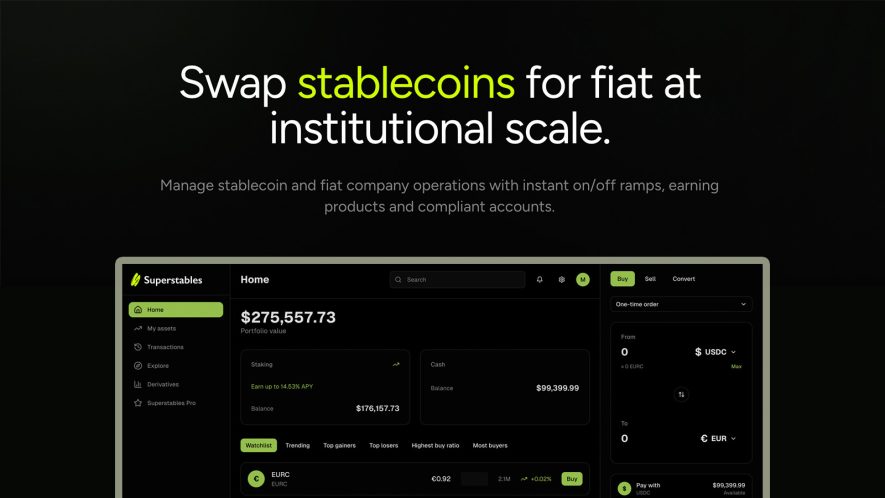

Lisbon — September 15, 2025 – If your company holds stablecoins and needs clean, fast access to euros or dollars (and back), Superstables is worth a look. It’s an institutional rail for two-way conversion between stablecoins and EUR/USD – with settlement either on-chain or direct to your bank (SEPA today, expanding). The pitch is deliberately simple: best net rate, policy-clean routes, and audit-ready receipts – without asking your finance team to become crypto experts.

👉 Learn more: www.superstables.com

What Superstables does (in plain English)

- Stablecoin ↔ Fiat, both ways: Turn USDC into EUR (to IBAN) or EUR into USDC (to your wallet). On-chain stable↔stable swaps (e.g., USDC ↔ EURC) are live as well.

- Wallet or bank settlement: Choose on-chain delivery or a bank payout—same interface, same receipt trail.

- Low basis points, upfront: Quotes show best net rate (fees, gas, slippage included) before you confirm.

- Finance-ready: Roles and approvals, invoices and statements, CSV/API exports—easy to reconcile.

- Compliance in the background: Policy-aware routing, KYC/KYB and sanctions screening via regulated partners, and a full audit trail for every transaction.

Why it matters now

Stablecoins move value globally in minutes. The challenge for most businesses isn’t speed – it’s doing it cleanly: region-appropriate assets, screened flows, predictable settlement, and documentation you can actually file. Superstables wraps crypto-speed in finance-friendly controls so operators and auditors can both sleep at night.

How it works (three steps)

- Request a live quote for your route (e.g., USDC → EURC, or USDC → EUR to IBAN).

- Confirm and settle to a wallet or bank account, with clear timing expectations.

- Reconcile using the receipts and statements generated automatically (or pull them via API).

Who uses it

- PSPs & marketplaces moving cross-border funds.

- Corporate treasuries managing USD↔EUR exposure.

- Fintechs & exchanges needing dependable stablecoin rails.

- Funds/market makers that want fast, policy-clean settlement.

What’s live vs. what’s next

- Available today

- USDC ↔ EURC on-chain with tight spreads.

- USDC → EUR to IBAN (SEPA) via regulated payout partners.

- Two-way conversions between stablecoins and EUR/USD (where supported), with receipts and exports.

On the roadmap

- Broader asset coverage: Adding major USD/EUR stablecoins beyond USDC/EURC, enabled by region and policy.

- Conservative savings in USDC and EURC: deposit, convert, and allocate to transparent, low-risk yield with clear withdrawal rules.

- Crypto payments: fiat-in → stable-out and stable-in → fiat-out, with real-time tracking from initiation to settlement.

- More corridors & redundancy: additional payout partners and rails for higher uptime and faster posting.

- Safety, in one paragraph

- Superstables is built with policy-aware routing (region, asset, counterparty rules), peg monitoring (automatic safeguards during stress), and licensed partners for bank payouts. Every action produces an audit-ready trail -quotes, route decisions, fees, counterparties, and settlement references – so finance and compliance teams aren’t left guessing.

Get started

If your team needs reliable, low-bps conversion between stablecoins and EUR/USD, either on-chain or to your bank, Superstables keeps it simple and compliant.

👉 www.superstables.com